Onboarding project | Acko Insurance

Acko Insurance Onboarding Strategy: Guiding Users to Value and Retention

Overview of the Onboarding Strategy

Acko’s onboarding process will be a digital-first, ICP-personalized journey that guides new users from sign-up to experiencing the core value of their insurance product (e.g., affordable coverage, instant claims, partnership perks like Cult.fit gym access or WeFast courier insurance). The strategy focuses on three pillars: Simplicity (easy sign-up and policy setup), Value Delivery (showcasing benefits tailored to ICPs), and Engagement (encouraging retention through education and perks). The goal is to achieve a 90% activation rate (users completing their first meaningful action, e.g., policy purchase or perk activation) and a Day 30 retention rate of 80%.

Defining Acko Insurance’s ICPs Using the Framework

Below is the completed framework table for Acko’s three ICPs: Newly United Adventurers, Young Urban Professionals, and Gig Economy Workers. The ICPs are tailored to Acko’s digital-first insurance model, focusing on their needs, pain points, and behaviors during onboarding to ensure they experience value quickly and return.

Criteria | User 1: Newly United Adventurers | User 2: Young Urban Professionals | User 3: Gig Economy Workers |

|---|---|---|---|

Age | 25-35 | 25-35 | 25-40 |

Demographics | Newlyweds, urban, middle to upper-middle class, tech-savvy, likely starting a family, dual-income households. | Single or early family, urban, middle to upper-middle class, tech-savvy, professionals (e.g., IT, marketing), often renters. | Freelancers/delivery riders, urban/semi-urban, lower to middle class, budget-conscious, often single or primary earners. |

Need | Affordable health and car insurance for new assets (e.g., car, health for starting a family), wellness perks to start healthy habits together. | Flexible, affordable health and gadget insurance (e.g., phone, laptop), travel insurance for frequent trips, digital-first solutions. | Affordable bike insurance for work, micro-insurance for deliveries (e.g., WeFast), roadside assistance, budget-friendly health coverage. |

Pain Point | Overwhelmed by complex insurance processes, high costs, lack of couple-focused benefits (e.g., wellness perks). | Lack of time for insurance research, fear of gadget damage/loss, high premiums for low usage (e.g., travel), poor digital UX. | High insurance costs relative to income, frequent bike breakdowns, delivery risks (e.g., package damage), limited digital literacy. |

Solution | Acko FitShield (health insurance + Cult.fit gym access), simplified onboarding with couple-focused perks, quick claims (24-hour settlement). | Acko Health/Gadget Insurance with WeFast CourierShield integration, app-based onboarding, instant claims, affordable premiums (e.g., INR 5,000/year). | Acko Bike Insurance (INR 840/year) with roadside assistance, WeFast CourierShield (INR 2/delivery), simplified sign-up (Aadhaar OTP), practical tutorials. |

Behavior | Research online (Google, Instagram), value couple-oriented experiences, prefer digital payments, seek value-added perks (e.g., gym access). | Heavy app usage, research via YouTube/Google, prefer digital-first solutions, value convenience (e.g., quick claims), frequent online purchases (e.g., gadgets). | Use apps for work (e.g., Zomato, WeFast), budget-driven decisions, prefer SMS notifications, low digital literacy, rely on practical benefits (e.g., roadside assistance). |

Perceived Value of Brand | Acko as a modern, couple-friendly insurer with affordable plans and wellness perks (e.g., Cult.fit access), trusted for quick claims (NPS +90). | Acko as a digital-first, affordable insurer for professionals, trusted for quick claims and partnerships (e.g., Amazon, WeFast), aligns with tech-savvy lifestyle. | Acko as a budget-friendly, practical insurer for gig workers, trusted for low-cost plans (e.g., INR 840 bike insurance) and partnerships (e.g., Zomato, WeFast). |

Goals | Protect new assets (car, health), start healthy habits together, save money on insurance, build a secure future. | Protect gadgets/health, travel with peace of mind, save time/money on insurance, maintain a digital-first lifestyle. | Protect bike for work, insure deliveries, minimize costs, access practical support (e.g., roadside assistance), ensure financial stability. |

Frequency of Use Case | Monthly (eg: occasional claims, annual policy renewal.) | Bi-monthly (e.g: occasional travel insurance), annual renewal, frequent app logins for claims/perks. | Weekly (e.g: roadside assistance), monthly health check-ins, annual renewal, app usage for practical needs. |

Average Spend on the Product | INR 9,490/year | INR 5,000-7,000/year | INR 840-2,000/year |

Value Accessibility to Product | High: Digital-first (app/website), 24/7 helpline (1800-266-2256), paperless claims. | High: App-based, social login, instant claims, tailored recommendations via quiz. | Moderate: Simplified sign-up (Aadhaar OTP), SMS notifications, practical tutorials, but limited by digital literacy. |

Value Experience of the Product | High: Affordable couple-focused insurance, quick claims, gamified onboarding (Acko Coins). | High: Digital-first, affordable, quick claims (24-hour), personalized onboarding. | Moderate-High: Low-cost, practical benefits (roadside assistance, quick claims, but onboarding needs to address digital literacy gaps. |

Prioritization Framework Mapping

I’ll evaluate each ICP against the criteria (Adoption Rate, Appetite to Pay, Frequency of Use Case) and estimate their Distribution Potential (TAM) based on prior market size calculations (e.g., TAM: 400.4M potential customers, SAM: 200.2M urban/digital-first users).

Criteria | Newly United Adventurers (ICP 1) | Young Urban Professionals (ICP 2) | Gig Economy Workers (ICP 3) |

|---|---|---|---|

Adoption Rate | Moderate | High | Low |

- Tech-savvy, urban, but new to insurance (25-35 age group). - May need education on benefits (e.g., Cult.fit perk), leading to moderate adoption. - ~80M in SAM (per prior data). | - Tech-savvy, urban, familiar with digital insurance (25-35). - High adoption due to digital-first lifestyle and Acko’s partnerships (e.g., WeFast, Amazon). - ~120M in SAM. | - Budget-conscious, moderate digital literacy (25-40). - Lower adoption due to financial constraints and digital barriers. - ~40M in SAM. | |

Appetite to Pay | High | High | Low |

- Middle/upper-middle class, dual-income. - Willing to pay for value-added perks (e.g., INR 9,490/year for Acko FitShield with Cult.fit access). | - Middle/upper-middle class, professionals. - Willing to pay for affordable, flexible plans (e.g., INR 5,000-7,000/year for health/gadget insurance, INR 2/delivery via WeFast). | - Lower/middle class, budget-driven. - Limited appetite to pay (e.g., INR 840/year for bike insurance, INR 2/delivery via WeFast). | |

Frequency of Use Case | Low | High | Moderate |

- Monthly gym visits (Cult.fit perk), occasional claims, annual renewal. - Less frequent interaction with insurance. | - Bi-monthly WeFast deliveries, frequent app logins for claims/perks, annual renewal. - High interaction due to digital-first lifestyle. | - Weekly WeFast deliveries, monthly roadside assistance, annual renewal. - Moderate interaction, primarily for work-related needs. | |

Distribution Potential (TAM) | 80M users / INR 759.2B | 120M users / INR 840B | 40M users / INR 80B |

- 80M newlyweds (25-35) in SAM (per prior data). - TAM: 80M × INR 9,490/year (Acko FitShield) = INR 759.2B. | - 120M professionals (25-35) in SAM. - TAM: 120M × INR 7,000/year (avg. spend) = INR 840B. | - 40M gig workers in SAM. - TAM: 40M × INR 2,000/year (avg. spend) = INR 80B. |

Jobs To Be Done (JTBD) Framework for Acko Insurance’s ICPs

Understanding JTBD for Acko’s ICPs

The JTBD framework identifies the jobs users are trying to accomplish by “hiring” Acko’s insurance products. These jobs include:

- Functional Job: The practical task or problem the product solves (e.g., “I need to protect my health”).

- Emotional Job: The feelings or emotional state the user wants to achieve (e.g., “I want to feel secure”).

- Social Job: How the user wants to be perceived by others (e.g., “I want to be seen as responsible”).

- Personal Job: The deeper personal motivation or self-fulfillment (e.g., “I want to achieve peace of mind”).

Goal Priority | Goal Type | ICP | JTBD | Validation Approach | Validation (User Interview Quote) |

|---|---|---|---|---|---|

Primary | Functional | Young Urban Professionals | Protect gadgets, health, and travel with affordable, digital-first insurance; insure frequent WeFast deliveries. | User interviews | “I want affordable insurance that protects my laptop and health without hassle, especially when I send packages via WeFast.” |

Primary | Emotional | Young Urban Professionals | Feel secure and in control knowing gadgets and health are protected without breaking the bank. | User interviews | “I need to feel secure knowing my gadgets are insured, and I don’t want to stress about high costs.” |

Secondary | Social | Young Urban Professionals | Be seen as a smart, tech-savvy professional who makes efficient, modern choices (e.g., digital insurance, WeFast integration). | User feedback surveys | “I want my peers to see me as someone who makes smart, tech-savvy choices, like using Acko for digital insurance.” |

Tertiary | Personal | Young Urban Professionals | Achieve peace of mind and convenience, aligning with a fast-paced, digital-first lifestyle. | User behavior analytics | “I want peace of mind so I can focus on my busy life, knowing Acko’s app makes insurance easy.” |

Primary | Functional | Newly United Adventurers | Protect new assets (car, health) with affordable insurance; access wellness perks (e.g., Cult.fit gym). | User interviews | “I want affordable insurance for our new car and health, plus perks like gym access to stay healthy together.” |

Primary | Emotional | Newly United Adventurers | Feel confident and prepared as a couple starting a new life together, with health and assets secured. | User interviews | “I want to feel confident that we’re starting our marriage with the right protection and healthy habits.” |

Secondary | Social | Newly United Adventurers | Be seen as a responsible, forward-thinking couple who prioritizes health and security (e.g., Cult.fit perk). | User feedback surveys | “I want our friends to see us as a responsible couple who takes care of our health and future.” |

Tertiary | Personal | Newly United Adventurers | Build a secure, healthy foundation for their marriage, ensuring long-term stability and well-being. | User behavior analytics | “I want to build a strong foundation for our marriage, knowing we’re secure and healthy.” |

Primary | Functional | Gig Economy Workers | Protect bike and deliveries (via WeFast) with low-cost insurance; access roadside assistance for work. | User interviews | “I need cheap bike insurance and delivery protection so I can keep working without worrying about breakdowns or losses.” |

Secondary | Emotional | Gig Economy Workers | Feel relieved and supported, knowing work tools (bike, deliveries) are insured affordably. | User interviews | “I want to feel relieved knowing my bike and deliveries are covered, so I’m not stressed about unexpected costs.” |

Tertiary | Social | Gig Economy Workers | Be seen as a dependable gig worker who takes care of their work tools (e.g., bike insurance, WeFast deliveries). | User feedback surveys | “I want my employer and customers to see me as dependable because I protect my bike and deliveries.” |

Tertiary | Personal | Gig Economy Workers | Maintain financial stability and reduce stress, ensuring they can continue earning a living. | User behavior analytics | “I want to keep earning without financial stress, knowing my work tools are insured affordably.” |

Onboarding Teardown: Step-by-Step Analysis

Step 1: Play Store Search ("health insurance")

Screenshot Description: Play Store search results for "health insurance," showing Acko’s app among competitors (Star Health, Care Health, Policybazaar, etc.) with a 4.6 rating, 24 MB size, and 1Cr+ downloads.

- What is Working Well and Why?

- High Visibility: Acko’s app appears in the search results with a strong 4.6 rating and 1Cr+ downloads, building trust and credibility for users looking for a reliable insurance app.

- App Size: At 24 MB, the app is lightweight compared to competitors (e.g., Care Health at 114 MB), appealing to users with limited storage or slower internet.

- Clear Naming: “Buy Health Insurance from ACKO” is straightforward, immediately conveying the app’s purpose, which aligns with user intent (searching for health insurance).

- What is Not Working and Why?

- Lack of Differentiation: The app listing doesn’t stand out visually or descriptively compared to competitors (e.g., Policybazaar’s “Compare & Buy” highlights a unique feature). Users may not understand Acko’s unique value (e.g., paperless, instant claims) at this stage.

- No Visual Appeal: The app icon is generic (purple gradient), lacking a distinct visual identity compared to competitors with more recognizable branding (e.g., TATA AIG’s logo). (Subjective)

- Suggested Improvements and Why They’d Be Better:

- Add a Tagline in the Title: Update the app name to “Buy Health Insurance from ACKO – Instant Claims” to highlight a key differentiator (instant claims), making it more compelling and relevant to user needs (quick, hassle-free insurance).

- Redesign the App Icon: Use a more distinctive icon (e.g., a shield or checkmark symbol) to visually convey protection and trust, helping the app stand out in a crowded list.

- These changes would better capture user attention and communicate Acko’s value proposition early, increasing the likelihood of a download.

- Cognitive Biases:

- Social Proof Bias: The 4.6 rating and 1Cr+ downloads leverage social proof, encouraging users to trust Acko because others have. This is effective but could be amplified with a tagline to reinforce the choice.

- Choice Overload: The long list of similar apps may overwhelm users, leading to decision fatigue. Highlighting a unique feature (e.g., instant claims) could reduce this by making Acko a clearer choice.

Step 2: Play Store App Page

Screenshot Description: Acko’s Play Store page with a 4.6 rating, 3L reviews, 24 MB size, “Install” button, and a description: “Buy Health Insurance with Zero Waiting, No Co-pay, 100% Cashless & Instant Claims.”

- What is Working Well and Why?

- Clear Value Proposition: The description highlights key benefits—“Zero Waiting, No Co-pay, 100% Cashless & Instant Claims”—which directly address common user pain points (delays, hidden costs, complex claims), making the app appealing.

- Trust Signals: The 4.6 rating, 3L reviews, and “Trusted by over 8 crore users” banner build credibility, reassuring users of reliability. & the face of R. Madhavan also builds credibility in a big way, which they have used very well! It's a video highlighting their CVP.

- Lightweight App: The 24 MB size is reiterated, ensuring users with limited storage feel confident about downloading.

- What is Not Working and Why?

- No Immediate Call to Action: While the “Install” button is prominent, the page doesn’t create urgency (e.g., a limited-time offer) to encourage immediate action, which could lead to drop-off if users scroll further and get distracted.

- Suggested Improvements and Why They’d Be Better:

- Add Urgency: Include a limited-time offer (e.g., “Download now and get 10% off your first policy!”) to create a sense of urgency, leveraging the scarcity bias to drive installs.

- Cognitive Biases:

- Anchoring Bias: The “Trusted by over 8 crore users” sets a strong anchor of trust, making users more likely to perceive Acko as a safe choice. This is effective.

- Scarcity Bias: Missing an opportunity here—adding a limited-time offer could tap into users’ fear of missing out, prompting quicker action.

Step 3: App Launch and Notification Permission

Screenshot Description: App launch screen with “Simple. Fast. Paperless.” and a pop-up: “Allow ACKO to send you notifications?” with “Allow” and “Don’t allow” options.

- What is Working Well and Why?

- Clear Messaging: “Simple. Fast. Paperless.” sets a positive tone, aligning with user needs for a hassle-free experience, which builds early trust.

- Permission Request: The notification pop-up is concise and gives users a clear choice (“Allow” or “Don’t allow”), respecting user autonomy and avoiding overwhelm.

- What is Not Working and Why?

- Lack of Context for Notifications: The pop-up doesn’t explain why notifications are useful (e.g., policy updates, claim status), [ps* I understand this is an system prompted permission] which might lead users to decline, missing out on future engagement opportunities & is there a need to show it in the 1st step itself?

- Generic Visuals: The background image (a phone with insurance icons) is functional but doesn’t emotionally engage users or reinforce the app’s value proposition at this early stage.

- Suggested Improvements and Why They’d Be Better:

- Add Context to Notification Request: Update the pop-up to “Allow ACKO to send you notifications for policy updates and instant claim status?” This provides a clear benefit, increasing the likelihood of users opting in by addressing their need for timely information. [ps* I understand this is an system prompted permission]

- Enhance Visuals: Replace the generic background with a more engaging image (e.g., a smiling user receiving a claim confirmation), making the experience feel more personal and reinforcing the value of a hassle-free process.

- These changes would improve user engagement by making the benefits of notifications clear and creating an emotional connection early in the journey.

- Cognitive Biases:

- Default Bias: The “Allow” button is prominent, which may encourage users to opt in by default. However, without context, this could backfire if users feel uninformed.

- Priming Bias: “Simple. Fast. Paperless.” primes users to expect a seamless experience, which is effective but could be undermined if later steps don’t deliver on this promise.

Step 4: Initial Login Screen

Screenshot Description: “Simple. Fast. Paperless. Meet ACKO Insurance.” with options: “Log in with mobile number,” “Log in with work email,” and a link for “Have a corporate health policy?”

- What is Working Well and Why?

- Multiple Login Options: Offering mobile number and work email login caters to different user preferences, reducing friction and making the process inclusive.

- Reinforced Messaging: “Simple. Fast. Paperless.” is repeated, reinforcing the app’s core promise and building consistency in user expectations.

- Corporate Option: The “Have a corporate health policy?” link addresses users with existing policies, ensuring they feel included and can proceed easily.

- What is Not Working and Why?

- Lack of Social Login: There’s no option for social login (e.g., Google, Facebook), which could frustrate users who prefer faster, one-tap login methods, increasing drop-off.

- No Value Reinforcement: The screen doesn’t remind users of the app’s benefits (e.g., instant claims, cashless process), missing an opportunity to keep them motivated to proceed.

- Suggested Improvements and Why They’d Be Better:

- Add Social Login: Include Google/Facebook login options to reduce friction for users who prefer quick sign-ins, improving completion rates by catering to modern login habits.

- Reinforce Value: Add a small tagline below “Meet ACKO Insurance,” such as “Instant Claims, 100% Cashless,” to remind users of the app’s benefits, keeping them engaged and motivated.

- These changes would streamline the login process and maintain user momentum by reinforcing the app’s value.

- Cognitive Biases:

- Choice Overload: Offering multiple login options is good, but without social login, some users might feel limited, leading to decision fatigue. Adding more options could balance this.

- Priming Bias: The repeated “Simple. Fast. Paperless.” continues to prime users for a seamless experience, which is effective but needs to be backed up by later steps.

Step 5: Phone Number Entry

Screenshot Description: “Log in with your phone number” with a field for entering the mobile number (+91 country code pre-filled) and a “Log in” button.

- What is Working Well and Why?

- Simplicity: The screen is clean and focused, with a single task (enter phone number), reducing cognitive load and making it easy to proceed.

- Pre-filled Country Code: The +91 code is pre-filled, saving time for users in India (Acko’s primary market) and reducing friction. (I know Acko only works in India but it's good to have thing)

- What is Not Working and Why?

- No Privacy Assurance: Users entering their phone number might worry about data privacy, especially since this is an early step, and there’s no immediate reassurance (e.g., a privacy link is present but not prominent). People are very scared of the spamming problem, which is especially high for insurance companies.

- Lack of Guidance: There’s no indication of what happens next (e.g., OTP verification), which might make users hesitant if they’re unsure about the process.

- Suggested Improvements and Why They’d Be Better:

- Prominent Privacy Assurance: Move the “Privacy policy” link closer to the input field and add a brief note, e.g., “Your data is safe with us,” to address privacy concerns, building trust at this sensitive step.

- Add Next-Step Guidance: Include a small text below the field, like “We’ll send you an OTP to verify,” to set expectations and reduce uncertainty, making users feel more confident.

- These changes would improve user confidence and clarity, reducing drop-off during this critical step.

- Cognitive Biases:

- Framing Bias: Framing the login as “simple” (via the clean design) is effective, but the lack of clarity on the next step might create anxiety, counteracting the positive framing.

- Default Bias: Pre-filling the +91 code assumes the user is in India, which works for most but might confuse international users (though this is a minor issue given Acko’s market focus).

Step 6: OTP Verification

Screenshot Description: “Your OTP is on its way” with the phone number and fields to enter the OTP, a “Resend OTP in 00:28” timer, and an “Auto-fill code from messages” option.

- What is Working Well and Why?

- Clear Instructions: The screen clearly states the OTP has been sent and shows the phone number, reducing confusion and setting expectations.

- Auto-fill Feature: The “Auto-fill code from messages” option simplifies the process, catering to users who want a seamless experience, especially on mobile devices.

- Resend Option: The “Resend OTP” timer (00:28) provides a fallback, ensuring users don’t feel stuck if they miss the OTP.

- What is Not Working and Why?

- No Visual Feedback: There’s no loading animation or visual cue while waiting for the OTP, which might make users feel uncertain if the system is working.

- Lack of Support Option: If the OTP doesn’t arrive, there’s no immediate support link (e.g., “Contact us”), which could frustrate users who encounter issues.

- Suggested Improvements and Why They’d Be Better:

- Add a Loading Animation: Include a subtle loading spinner or progress bar while the OTP is being sent, providing visual feedback that the system is active, which would reduce uncertainty and improve trust.

- Include a Support Link: Add a “Didn’t receive OTP? Contact us” link below the resend timer, linking to Acko’s 24/7 helpline, to provide immediate assistance and reduce frustration.

- These changes would enhance user confidence and ensure a smoother verification process, reducing drop-off.

- Cognitive Biases:

- Confirmation Bias: Users who expect a seamless process (primed by “Simple. Fast. Paperless.”) may feel reassured by the auto-fill feature.

- Loss Aversion (dislike): The resend timer creates a sense of urgency, tapping into users’ fear of missing out on the OTP, which encourages them to stay engaged & also make sure that they can get another try at it.

Step 7: Name Confirmation

Screenshot Description: “Hey, glad to see you! Please check if we’ve got your name right” with fields showing “Dhruv Dixit” and a “Continue” button.

- What is Working Well and Why?

- Personal Touch: The greeting “Hey, glad to see you!” feels warm and welcoming, creating an emotional connection early in the onboarding process.

- Pre-filled Name: Pre-filling the name (Dhruv Dixit) saves time and shows the app is smart, enhancing the perception of a seamless experience.

- Editable Fields: Users can correct the name if needed, giving them control and ensuring accuracy.

- What is Not Working and Why?

- Lack of Value Reinforcement: The screen doesn’t remind users of the app’s benefits, missing an opportunity to keep them motivated during this step.

- No Skip Option: If users don’t want to share their name or if the pre-filled name is incorrect, there’s no “Skip” option, which might feel intrusive to privacy-conscious users.

- Suggested Improvements and Why They’d Be Better:

- Add a Skip Option: Include a “Skip for now” link below the “Continue” button to give users flexibility, respecting their privacy preferences and reducing friction.

- Reinforce Value: Add a small tagline, e.g., “Let’s get you protected with instant claims!” to remind users of the app’s benefits, keeping them engaged.

- These changes would make the step more user-friendly and maintain momentum by reinforcing the app’s value.

- Cognitive Biases:

- Halo Effect: The friendly greeting and pre-filled name create a positive first impression, making users more likely to view the entire app favorably.

- Commitment Bias: Asking for the name commits users to the process, making them more likely to continue, but a skip option would balance this with user autonomy.

Step 8: Marital Status Question

Screenshot Description: “What’s your marital status?” with options: “Married,” “Unmarried,” “Married and have kids,” “I’d rather not say,” and a “Continue” button.

- What is Working Well and Why?

- Inclusive Options: The range of choices, including “I’d rather not say,” respects user privacy and ensures inclusivity, reducing friction for those who don’t want to share.

- Progress Indicator: The progress bar at the top shows users they’re moving forward, providing a sense of accomplishment and clarity on the onboarding length.

- What is Not Working and Why?

- Privacy Concerns: Asking for marital status might feel intrusive to some users, especially since it’s not immediately clear how this information benefits them (e.g., personalized recommendations).

- Disabled Continue Button: The “Continue” button is greyed out until a selection is made, which might frustrate users who want to skip this step.

- Suggested Improvements and Why They’d Be Better:

- Explain the Purpose: Add a brief note, e.g., “This helps us recommend the best insurance for you,” to clarify why the question is asked, building trust and reducing perceived intrusiveness.

- Enable Skip via Default: Allow the “Continue” button to be active with “I’d rather not say” pre-selected, giving users the option to proceed without sharing, which would respect privacy and reduce friction.

- These changes would make the step feel less invasive and more user-centric, improving completion rates.

- Cognitive Biases:

- Default Bias: The lack of a pre-selected option forces a choice, which might annoy users. Pre-selecting “I’d rather not say” could leverage this bias positively.

- Framing Bias: Framing the question as part of personalization (with a brief note) would make it feel more beneficial, encouraging participation.

Step 9: Insurance Coverage Question

Screenshot Description: “What insurance coverage do you have?” with checkbox options: “Car insurance,” “Bike/scooter insurance,” “Personal health insurance,” “Company provided health insurance,” “Life insurance,” “None of the above,” and a “Continue” button.

- What is Working Well and Why?

- Comprehensive Options: The list covers a wide range of insurance types, ensuring users can accurately reflect their coverage, which helps the app tailor recommendations.

- Checkbox Format: Allowing multiple selections reflects the reality that users may have various types of coverage, making the question practical and user-friendly.

- Progress Indicator: The progress bar continues to provide clarity on the onboarding journey, maintaining user momentum.

- What is Not Working and Why?

- Potential Overwhelm: The list of options might feel long for users who don’t have any coverage or aren’t sure, leading to decision fatigue.

- Lack of Context: There’s no explanation of how this information will be used (e.g., to avoid redundant recommendations), which might make users hesitant to answer.

- Suggested Improvements and Why They’d Be Better:

- Simplify the List: Group similar options (e.g., “Vehicle insurance” for car/bike) to shorten the list, reducing cognitive load and making the step quicker to complete.

- Add Context: Include a brief note, e.g., “This helps us avoid recommending coverage you already have,” to clarify the benefit, building trust and encouraging accurate responses.

- These changes would streamline the process and make the question feel more relevant, improving user engagement.

- Cognitive Biases:

- Choice Overload: The long list might overwhelm users, leading to drop-off. Simplifying the options would mitigate this.

- Priming Bias: The progress bar primes users to feel they’re close to completion, which is effective for maintaining momentum.

Step 10: Personalization Loading Screen

Screenshot Description: “Great! We are personalising your app” with an animation of a hand stacking blocks.

- What is Working Well and Why?

- Visual Feedback: The animation of a hand stacking blocks provides a clear visual cue that the app is working, reducing uncertainty during the loading process.

- Positive Messaging: “Great! We are personalising your app” reassures users that their input (e.g., marital status, coverage) is being used to tailor the experience, building trust.

- What is Not Working and Why?

- Lack of Time Estimate: There’s no indication of how long the personalization will take, which might make users impatient if the process is slow.

- Missed Opportunity for Engagement: The screen doesn’t provide additional value (e.g., a quick tip about the app’s benefits) while users wait, missing a chance to reinforce the app’s value.

- Suggested Improvements and Why They’d Be Better:

- Add a Time Estimate: Include a subtle timer or progress percentage (e.g., “Personalizing… 80%”) to set expectations, reducing impatience and improving user trust.

- Provide a Value Tip: Add a small tip, e.g., “Did you know? Our claims are processed in 24 hours!” to keep users engaged and reinforce the app’s benefits while they wait.

- These changes would make the waiting period more transparent and engaging, enhancing the user experience.

- Cognitive Biases:

- Expectation Bias: The “personalising” message sets an expectation of a tailored experience, which is effective if the next screen delivers on this promise.

- Halo Effect: The positive messaging and animation create a favorable impression, making users more likely to view the app positively.

Step 11: Welcome Screen Post-Account Creation

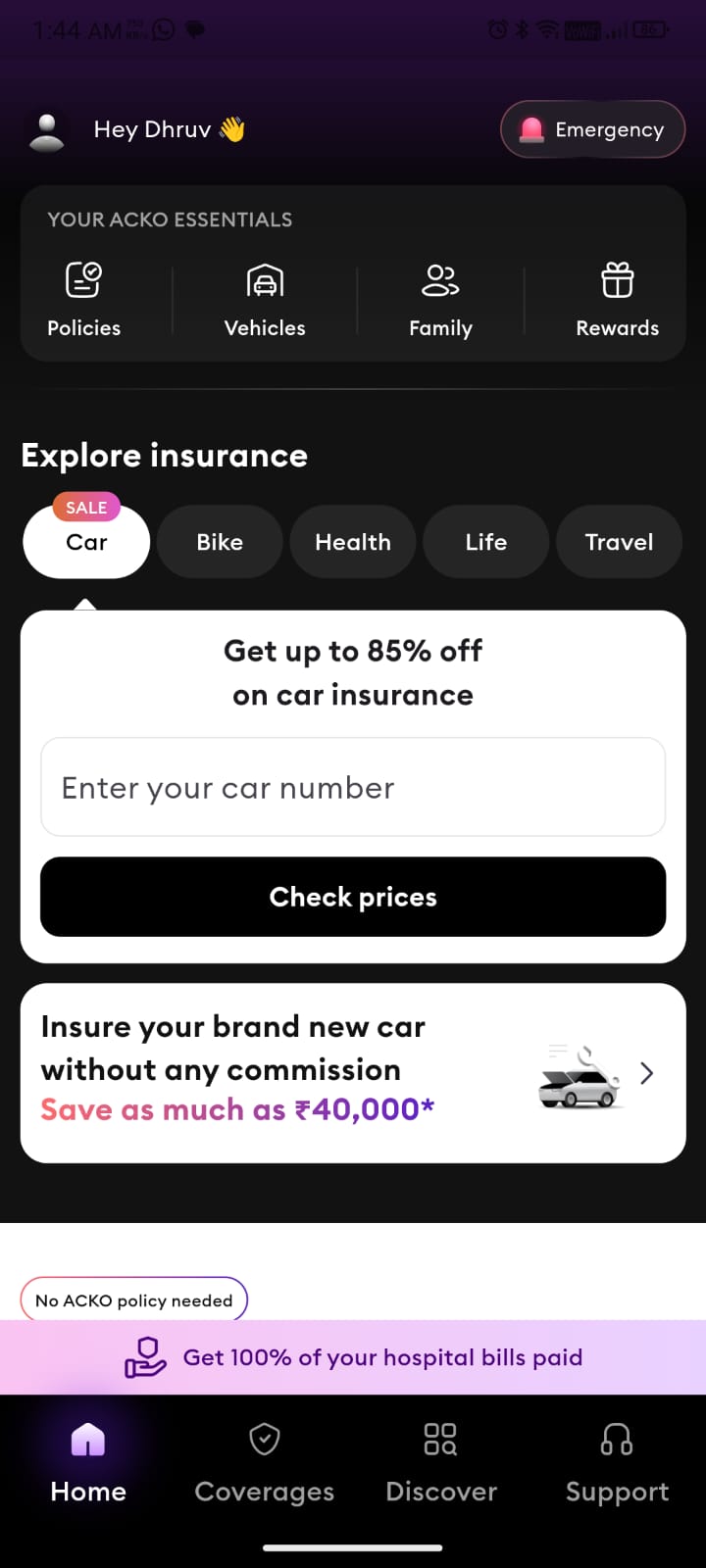

Screenshot Description: “Hey Dhruv! Let’s set up your app real quick” with a “Get started” button, followed by a home screen showing “Your ACKO essentials” (Policies, Vehicles, Family, Rewards) and “Explore insurance” options (Car, Bike, Health, Life, Travel).

- What is Working Well and Why?

- Personalized Greeting: “Hey Dhruv!” continues the personal touch, making the experience feel welcoming and user-centric.

- Clear Next Steps: “Let’s set up your app real quick” with a “Get started” button provides a clear call to action, guiding users smoothly into the next phase.

- Home Screen Overview: The home screen offers a clear dashboard with “Your ACKO essentials” and “Explore insurance” sections, giving users an immediate sense of what they can do (e.g., check policies, explore new coverage).

- What is Not Working and Why?

- No Immediate Value Demonstration: The welcome screen doesn’t showcase the app’s core benefits (e.g., instant claims, cashless process), missing an opportunity to create an “aha” moment early.

- Home Screen Clutter: The home screen has multiple sections (e.g., “Get up to 85% off on car insurance,” “Insure your brand new car”) without clear prioritization, which might overwhelm users who just want to explore their options.

- Suggested Improvements and Why They’d Be Better:

- Highlight a Key Benefit: On the welcome screen, add a tagline, e.g., “Explore insurance with instant claims!” to immediately showcase the app’s value, creating an early “aha” moment.

- Prioritize Home Screen Content: On the home screen, prioritize one key action (e.g., “Explore insurance” section) with a more prominent CTA (e.g., “Find the right coverage now”), reducing clutter and guiding users to the most relevant next step.

- These changes would create a stronger first impression and guide users more effectively, improving engagement and retention.

- Cognitive Biases:

- Halo Effect: The personalized greeting continues to build a positive impression, making users more likely to trust the app.

- Choice Overload: The home screen’s multiple sections might overwhelm users. Prioritizing one action would reduce this and improve focus.

Where Does the “Aha” Moment Occur?

- Current Flow: The “aha” moment is delayed until after account creation (Step 11), when users see the home screen and can explore insurance options. However, this is too late in the process, as users haven’t experienced the app’s core value (e.g., instant claims, hassle-free process) during onboarding.

- Ideal “Aha” Moment: The “aha” moment should occur earlier, ideally at Step 7 (Name Confirmation) or Step 8 (Marital Status Question), by showcasing a tangible benefit. For example, after name confirmation, a message like “Hi Dhruv! Your claims will be processed in 24 hours – let’s get started!” would demonstrate value immediately, making users feel the app’s promise of a seamless experience.

Cognitive Biases Across the Flow:

- Social Proof Bias: Effectively used in the Play Store (4.6 rating, 1Cr+ downloads) and app page (“Trusted by over 8 crore users”), building trust early.

- Priming Bias: “Simple. Fast. Paperless.” primes users for a seamless experience, which is reinforced through clean design but occasionally undermined by lack of clarity (e.g., no context for notifications, OTP wait time).

- Halo Effect: The friendly tone (“Hey, glad to see you!”) and personalized elements create a positive impression, making users more likely to view the app favorably.

- Choice Overload: Present in steps with long lists (e.g., insurance coverage question, home screen), which could be mitigated by simplifying options and prioritizing actions.

- Scarcity Bias: Missed opportunity in the Play Store page - adding a limited-time offer could drive installs. The OTP resend timer leverages this bias effectively.

Summary of Recommendations:

- Early Value Demonstration: Introduce a tangible benefit (e.g., “Claims processed in 24 hours”) at Step 7 or 8 to create an “aha” moment sooner, keeping users motivated.

- Reduce Friction: Add social login, skip options, and clearer context (e.g., for notifications, marital status) to respect user preferences and reduce drop-off.

- Enhance Engagement: Use visuals, time estimates, and value tips during loading screens to keep users engaged and reinforce the app’s benefits.

Activation Metrics for Acko Insurance Onboarding

Metric | Target | Insights from Onboarding | Recommendations |

|---|---|---|---|

D1, D7, D30 Retention | D1: 50%, D7: 20%, D30: 10% | Clean, personalized onboarding boosts D1, but lack of early “aha” moment may lower D7/D30. | Add a demo of a core feature (e.g., instant claims) post-name confirmation to drive early value and improve D7/D30 retention. |

DAU/MAU Ratio | 20-30% | Home screen encourages engagement, but notification opt-in lacks context, potentially lowering DAU. | Send a personalized push notification within 24 hours (e.g., “Check your policy options!”) to boost DAU. |

Subscription Rate vs. Retention | 5-10% subscription, D30 15% for subscribers | Home screen promotes insurance purchase, but no nudge during onboarding to drive early action. | Prompt users to explore policies post-personalization to increase subscriptions and tie to higher retention. |

Average TAT | <2 min (account creation), <30s (quote) | Account creation is fast (<2 min), but no immediate quote generation during onboarding. | Provide an instant quote post-personalization to reduce TAT for key actions like quote generation. |

User Cohorts | Varies by cohort | Users who engage with “Explore insurance” likely activate faster. | Personalize post-onboarding nudges based on cohort data (e.g., behavior, age, location) to boost activation. |

Acquisition Source | Varies by source | Organic users (via Play Store search) may have higher intent. | Tag users by acquisition source and optimize campaigns for high-activation sources (e.g., organic vs. paid). |

Product Reviews | 4.5+ rating | 4.6 rating is strong, but onboarding friction (e.g., no social login) may lead to mixed reviews. | Prompt in-app feedback post-onboarding (e.g., “How easy was it to get started?”) to address pain points and improve reviews. |

Onboarding Completion Rate | 90% | Lack of skip options (e.g., marital status question) may cause drop-off for some users. | Add skip options for non-essential steps to increase completion rates and reduce friction. |

Feature Adoption Rate | 50% in first session | Home screen prompts engagement, but no nudge during onboarding to drive feature use. | Add a guided tour post-personalization (e.g., “Let’s find the right insurance!”) to drive feature adoption. |

Time to First Action (TTFA) | <1 min post-account creation | First action delayed until home screen, potentially taking longer than 1 minute. | Prompt a quote request immediately after personalization to reduce TTFA and drive faster activation. |

Push Notification Opt-In Rate | 70% | Notification prompt lacks context, potentially lowering opt-in rates. | Add context to the prompt (e.g., “Get instant claim updates!”) to increase opt-in and support re-engagement. |

With this table, I have tried to explain the current specific metrics based on the metric given in the notes & have given the recommendations based on the insights I understood from the session by UD sir.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Abhishek

GrowthX

Udayan

GrowthX

Members Only

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Swati Mohan

Ex-CMO | Netflix India

Members Only

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Nishchal Dua

VP Marketing | inFeedo AI

Members Only

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Abhishek Patil

Co-founder | GrowthX

Members Only

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Tanmay Nagori

Head of Analytics | Tide

Members Only

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

GrowthX

Free Access

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Ashutosh Cheulkar

Product Growth | Jisr

Members Only

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Jagan B

Product Leader | Razorpay

Members Only

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.